Offshore Trust Services Can Be Fun For Anyone

Wiki Article

The Definitive Guide to Offshore Trust Services

Table of ContentsSome Known Details About Offshore Trust Services What Does Offshore Trust Services Do?The Facts About Offshore Trust Services RevealedGetting The Offshore Trust Services To Work

We at Business Configuration Worldwide can guide you via all this. If you might want our skilled guidance on how an overseas count on can fit right into your all natural offshore strategy and might want specialist aid in choosing a jurisdiction as well as trust company that finest suits your requirements, do not be reluctant to call us, we would be satisfied to assist.Wyoming constantly ranks among the most favored states in the nation in which to develop a Personal Trust fund Firm. In the last years, as families and riches administration professionals have begun to concentrate on the significance of picking a jurisdiction with a favorable count on climate, Wyoming's appeal as count on situs has actually seen exceptional growth.

When it involves Personal Trust fund Companies, there isn't a one-size-fits-all model. Wyoming is among just a few top-ranking states that permits the formation of controlled along with unregulated Personal Count on Companies. This provides us, at Frontier Administrative Providers, the largest of latitudes when it concerns aiding a family choose and also form the most ideal sort of Private Count on Company.

Wyoming has actually passed a 1,000 year limit on multigenerational trust funds. For a number of years, advisors distinguished between the 2 kinds of states - offshore trust services. The most recent stance, nonetheless, is that there is no sensible difference in between states that permit perpetual trust funds as well as those like Wyoming. Wyoming Allows Both Managed as well as Uncontrolled Personal Trust Firms: Wyoming is among just a couple of top-rated trust situs states that enable the development of unregulated as well as controlled personal count on business, both of which offer a high level of protection as well as privacy.

About Offshore Trust Services

Most families establishing Private Count on Companies in Wyoming select the unregulated version since they are inexpensive, easy to establish up and administer, require little year-to-year coverage, and also provide the best flexibility in terms of family members control and also framework. That stated, there are scenarios that ask for the regulated choice.With the adoption of the Attire Trust Code (UTC), Wyoming and a handful of various other states enable a trustee or recipient to change a count on with or without a court order - offshore trust services. Digital Rep Statutes: These laws clear up trust administration concerns when there are contingent, coming, on unascertainable beneficiaries. Asset Defense Regulations: Under Wyoming law, Frontier Administrative Providers has the ability to framework depends on as well as Personal Trust Business so that the properties they hold are considerably secured from the reach of lenders.

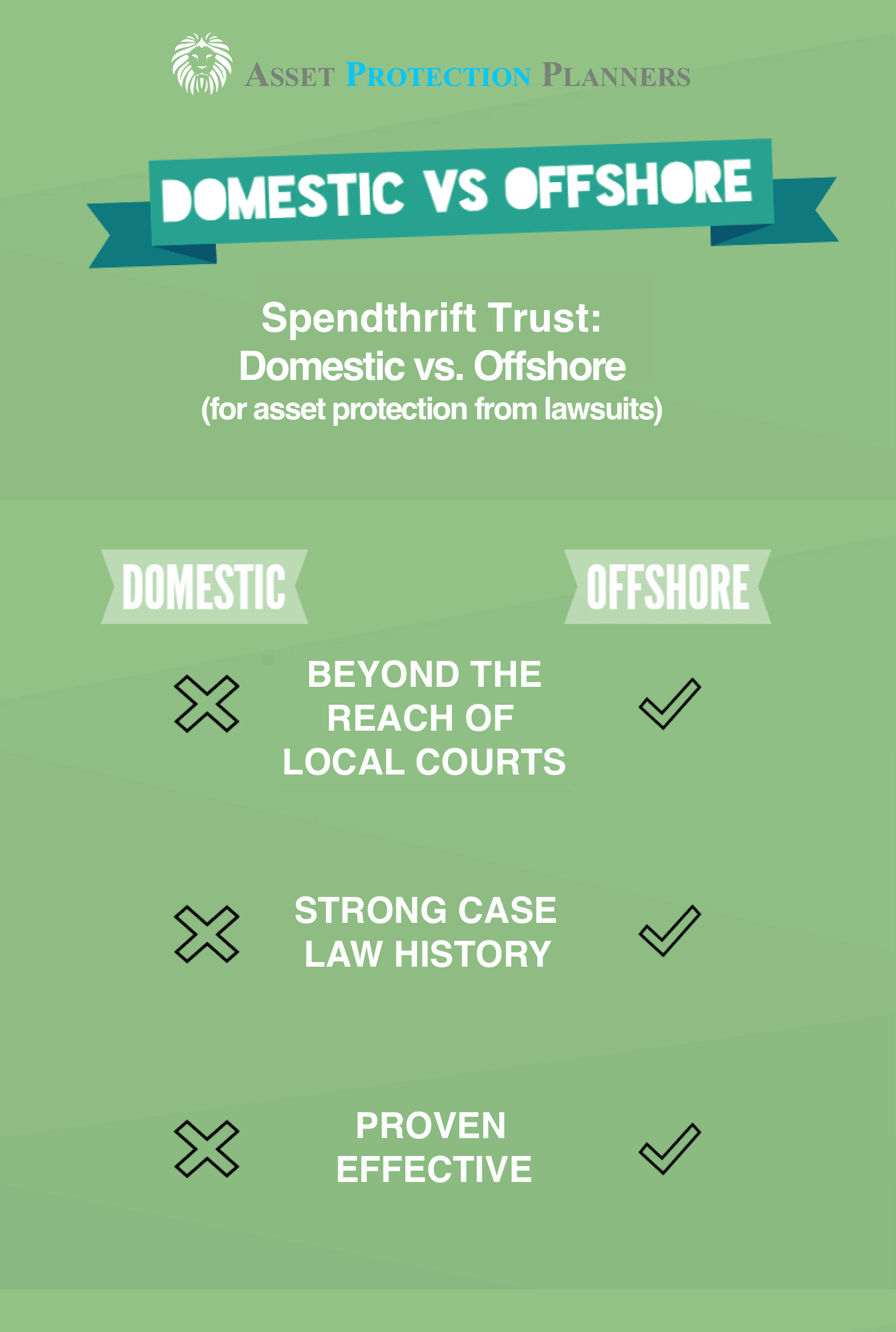

Such trust funds are a kind of spendthrift trust fund created by settlors for their very own advantage to supply property defense along with accomplish various other estate preparation goals. Optional Trusts: Wyoming statutes provide clear definitional advice concerning optional trust funds and, missing an abuse of discernment, stop creditors from compelling optional circulations.

Some Ideas on Offshore Trust Services You Need To Know

This indicates the borrower's ballot legal rights are not influenced, and also subsequently, the lender has no other way to compel a circulation. As long as the client can out-last the lender, it is likely the lender will opt for less. Wyoming has sole remedy charging order protection for LLCs as well as FLPs, plus added asset defense features for FLPs.Mark Davies is a leading authority on the tax advantages of establishing overseas count on structures with over two decades' experience both onshore and offshore. Trust funds are an ancient construct of English legislation where the lawful ownership and also valuable or equitable ownership of a possession or properties is split and held by various individuals.

A settlor will typically sign a "count on act" or "trust tool". This file will certainly define the trustees' powers as well as obligations. Trusts are usually defined as being "irrevocable" look at these guys or "revocable". A revocable count on is where the settlor may need the trustees to return the count on possessions to him or her on demand.

Offshore Trust Services Can Be Fun For Everyone

An overseas trust will pay absolutely no taxes in the tax obligation sanctuaries where trust development happened, overseas depends on are not enabled to possess properties in the tax obligation haven where they are registered and also the trust fund pay no taxes on asses possessed abroad. Offshore trusts pay no estate tax, capital gains tax, stamp responsibility and transfer fees, however a trust has to pay a yearly upkeep charge as well as an enrollment cost.

Offshore trust fund accounts can be established up at offshore banks in behalf of offshore counts on. Offshore counts on are not allowed to perform any type of commercial activity according to offshore count on regulations however can engage in the sale as well as acquisition of shares and also supply as long as these activities are to the benefit of the recipients of the offshore trust.

The settlor of an offshore depend on can also be called as a beneficiary of that depend on. The Trustee manages the trust fund according to the terms and problems set out in a Trust Deed.

Offshore rely on the tax havens are an exceptional for overseas investing and supply fantastic advantages.

Report this wiki page